One of many articles on management

A practical guide to Company Sick Pay

Written by John Berry on 22nd April 2021. Revised 4th March 2025.

4 min read

A few large organisations in the private sector pay Company Sick Pay (CSP).

A few large organisations in the private sector pay Company Sick Pay (CSP).

Many UK government employees, like nurses, police officers, and teachers, get full wages for up to a year of absence, so the government pays CSP too.

Some firms realise they must offer CSP to attract and retain key staff. Some even create a two-tier workforce with key staff paid CSP while others rely on Statutory Sick Pay (SSP).

SSP is currently just over £110 a week for up to 28 weeks, a low amount for most people. The UK SSP scheme lags behind sick pay schemes in EU states and in many other developed countries, which offer full wages for up to two years.

While all UK managers might like to pay full wages when an employee is off sick, only the government and a few private sector firms can afford such generosity.

So, what are other managers to do?

Typical absence

Managers typically staff their firms with employees commensurate with turnover. They assume a small number will be off sick at any one time and overstaff slightly to cope. They then budget to make a profit at this staffing level.

When an employee is off sick, the firm usually stops paying wages after a few days. The incremental cost to the firm is near zero, and the situation is managed.

But this isn’t sustainable in an environment where managers must find, attract, and retain good staff. Some compromise is needed to make the firm appear caring and employee-friendly. A scheme must be developed between expecting employees to rely solely on SSP and paying full wages indefinitely.

To develop this compromise, we first need to understand sickness patterns.

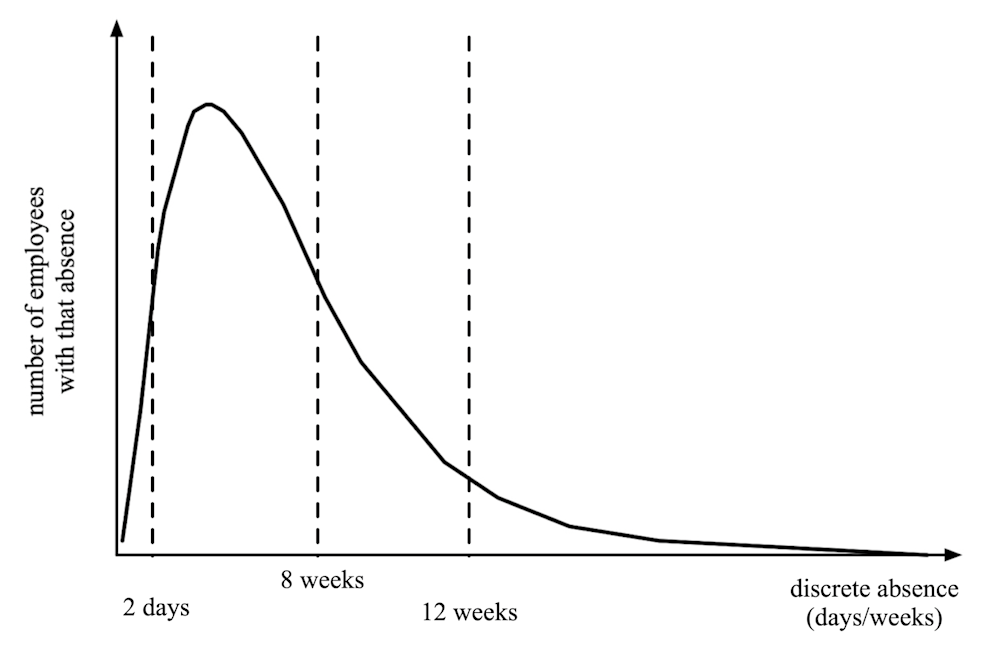

Staff sickness days typically follow a skewed normal curve. A few staff take one or two days a year, most take no more than eight weeks, and a small number take more than twelve weeks. A very small number (up to five percent) take long-term sick leave spanning months.

Proposed CSP scheme

Most firms don’t have the financial flexibility to pay CSP for longer periods, so a CSP scheme must be developed considering reasonable financial constraints and typical absence patterns.

We discuss the reasoning behind the model described here in our third edition of Because Your People Matter, a playbook for managers, entrepreneurs, and leaders.

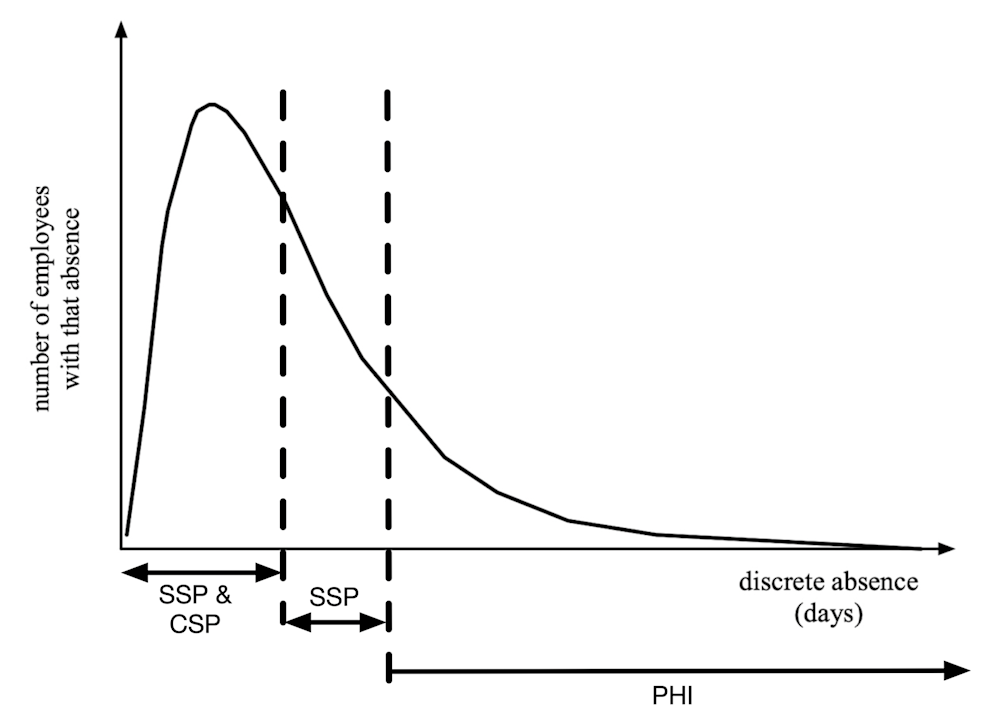

The figure below shows a solution. The firm implements a company sick pay scheme, paying full wages for six to eight weeks. Note that all CSP schemes must meet the employer’s obligation to pay SSP, which is offset against the CSP scheme’s generosity.

At six or eight weeks, CSP decreases, and the sick employee enters a moratorium period when the firm drops CSP to SSP levels. They must rely on their savings and the employer’s advice. To cover long-term sickness, the firm pays for Permanent Health Insurance (PHI), a standard income protection product provided by insurance companies.

PHI, bought by the firm for employees, is at modest cost. Various cover forms exist, with different moratorium periods and coverage options. The firm should decide its cover based on these options. For instance, it could fund 75% of wages for three months, then 50% for life.

The firm can secure better payouts because it insures multiple employees. A company scheme is viable, while personal insurance is less so.

Employee reaction

Employees typically like this scheme as it covers their two main concerns about falling sick:

- Short-term hardship from extended absences. The firm covers this risk and pays CSP.

- Long-term hardship from permanent disabilities. PHI covers this risk.

They may also worry about being off for longer than their CSP cover period (eight to twelve weeks). However, they accept this risk as the chance of such long-term sickness is low and they’ll just need a few thousand pounds in savings.

This structure resembles the ‘benefits’ of the French and Nordic systems, where governments maintain liveable sick pay levels for all. It’s a compromise that makes firms highly attractive to employees aged 25-45 who value caring support for their families. This ensures that no employee faces financial hardship during illness, allowing them to focus on recovery. However, CSP reducing to SSP latterly) and PHI, the firm’s financial burden is reduced.

This blog assumes managers want to support employees when sick to minimise strain on employee families and facilitate their return to work. Managers must also develop policies for employees with multiple periods off in a year.

For further discussion on suitable sick pay schemes for your firm, contact us at call us.